Cloud-native FCMs are a force to reckon with

Futures trading has experienced tremendous growth over the past 20 years. A January 2024, Futures Industry Association press release boasted that the previous year marked, “…the sixth consecutive year of record-setting trading activity in the global listed derivatives markets.”

In contrast, the number of futures commission merchants (FCMs) has declined. Many of the surviving firms — including the 10 largest based on customer funds holdings — are also large broker-dealers, subsidiaries of either a diversified financial services firm or a global bank.

This FCM consolidation/volume growth story isn’t new. However, there’s a new trend that speaks to the importance of technology in this market. While over a 10- or 20-year period, the number of FCMs is down, when you look with a shorter time horizon a different story emerges.

Over the past couple of years, there’s been a small increase — one or two a year — in the number of firms that have decided to take advantage of the growth in futures trading and become an FCM. What is more important than the number of firms entering the arena is the type of firm.

The original FCMs had their roots in agriculture but, new market entrants have their roots in cloud-based technology. Some are crypto-native firms expanding into traditional markets. Others started out serving retail equity traders. Regardless of their genesis, as we said in our 2023 digital transformation report, “These upstarts aren’t weighed down by legacy systems nor outdated thinking. They’re agile and tech obsessed.”

The rise of retail

Since the COVID-19 pandemic, retail participation in certain financial markets, including futures has grown. Many of these participants — a group FIA’s president has referred to as “protrail” traders — started with meme stocks before moving into options and then futures. Others entered through the crypto market.

Standing ready for their business was a new type of online broker, focused on the needs of these younger active traders. Unlike traditional brokers and FCMs, these firms offer their clients more educational tools and sophisticated risk controls. They are looking to grow their relationship with their clients as some of these active traders go on to become full-time day or swing traders.

Several senior leaders in the futures industry have spoken about the growth of the retail trader and how technology is blurring the line between retail and institutional. So, it makes sense that these firms are starting to move into the institutional space. For example, new FCM Robinhood bought its first institutional business, a global cryptocurrency exchange in June 2024.

Another advantage these independent, cloud-native firms have is that their retail customer base is a source of low-touch, high volume order flow. This is generally more profitable than the high-touch trades institutional traders often execute. The success of these low-touch trades depends on automation and algorithms. As an aside, this increased retail order flow benefits the entire futures market as it tends to be less correlated with the overall market.

The importance of technology

That technology can make or break their business is no surprise to any FCM.

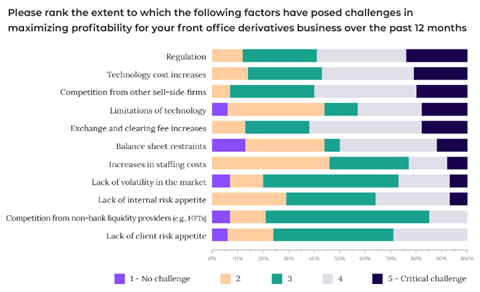

According to the 2024 research report on front-office FCM challenges we co-sponsored with Acuiti, a London-based management intelligence platform, approximately one-third of the executives surveyed saw their derivatives trading technology as a competitive advantage. At the same time, about 20% of this group saw the limits of their technology as a critical challenge to maximising profitability.

So, technology is both a competitive advantage and a potential threat to profitability? That makes sense when you look at the tech stack these established FCMs are working with compared to their emerging competitors.

The legacy hangover

The challenge of working with legacy technology stacks is one that the entire financial services sector is dealing with. In addition to having limited flexibility and being difficult to scale, legacy systems may inefficiently store data and require customised support. They may also compromise operational efficiency, a critical concern for FCMs.

The implications of an aging technology stack go beyond trading. There is often an impact on other critical business areas such as compliance and risk management. Technology also dictates much of the customer service experience. This is important for FCMs because, as the report stated: “… technology investment will be key to remaining competitive and enhancing their customer service”. In our experience, FCMs, like many sell-side firms, tend to offer a customised solution for each workflow. However, this results in a fragmented experience for their clients.

And, of course, the cost of maintaining and upgrading these systems can quickly eat up even the most generous technology budget.

Regaining that technology edge

FCMs need to become as agile and tech obsessed as these cloud-native firms. Luckily, it doesn’t matter whether you start as a plucky new start-up or well-seasoned FCM, the only the thing that matters is how you finish.

Replacing a legacy system with a modern cloud platform is a significant undertaking, especially if you chose to build it internally. Infrastructure is a scale game. Even firms that have the scale to build may decide to outsource, because building can distract valuable resources needed to serve the current business.

Earlier this year, Broadridge introduced a new SaaS for futures and options trading. Our goal was to create a scalable platform with unparalleled flexibility and data driven automation that provides FCMs with a comprehensive solution. In short, a comprehensive execution workspace.

In the build-versus-buy debate, customisation one of the perceived advantages of building. However, working with a solutions provider, rather than an in-house build, doesn’t mean that a firms must sacrifice a customised approach. The key is to work with a solutions provider that is flexible and open to customisation and offers an open-architecture platform that allows you to seamlessly integrate with other solutions.

London-based Christian Voigt has more than 15 years of experience as a product manager specializing in equity and derivatives market structure. Christian previously worked as a trading design manager at Eurex, a senior regulatory adviser at Fidessa and in business development at XETRA.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you