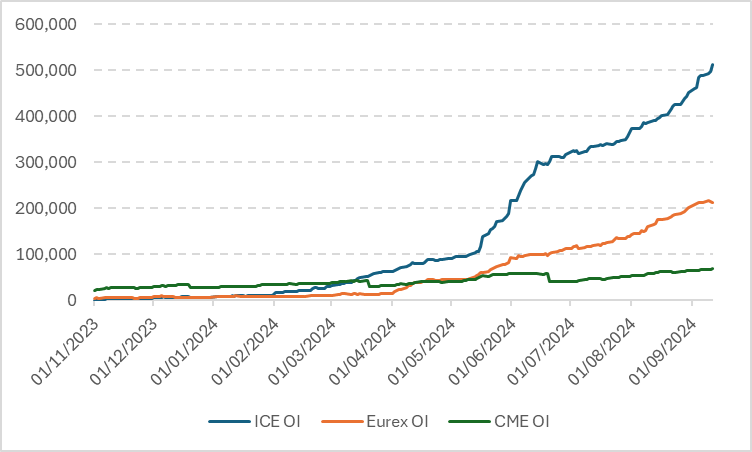

ICE cites ‘health and integrity’ of ESTR market as OI hits 500,000 lots

Intercontinental Exchange (ICE) has cited strong end user demand as the US group became this week the first exchange to break 500,000 lots of open interest in euro short-term rate (ESTR) futures.

The Atlanta-headquartered exchange group on Wednesday hit the new record (see graph 1), which represents a market share jump to 65% from 17% at the start of the year, according to exchange figures.

“The health and integrity of our ESTR market is being driven by end user demand that is benefiting from deeper liquidity available at ICE,” Caterina Caramaschi, vice president, financial derivatives at ICE, said in an emailed comment. “We’d like to thank all of our market participants for their continued support in developing our ESTR futures and we are pleased to see the first ESTR option trade.”

Graph 1

Source: exchange data

ICE is one of three exchanges in the European risk-free rate market, with Eurex holding 26% and CME Group having 8% of open interest as of September 11. Eurex hit a high of 216,301 lots in ESTR open interest on September 9, while CME hit its high of 68,521 contracts on September 11, in a sign the overall market is growing.

ICE last month reported the first ESTR option trades after listing the contracts in April, just ahead of CME which listed its own options contract in May. Rival Eurex has said it will focus on building its futures open interest before entering options.

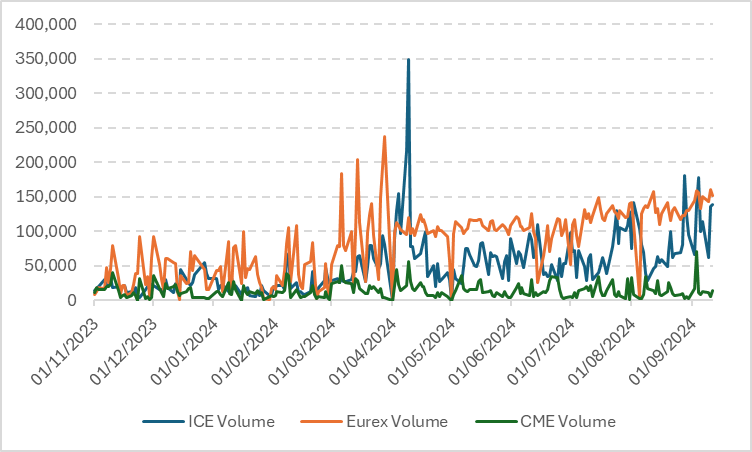

In volume terms, the picture has been more mixed, with exchanges having busy days at different points in the year (see graph 2). In the year to September 11, Eurex has the lead with a daily average of 95,055 contracts (57% of the total), compared to 58,442 lots for ICE (35%) and 14,608 contracts for CME (9%), according to calculations based on daily volumes.

Graph 2

Source: Exchange data

In a market summary published on Thursday, Eurex referenced ESTR as the standout performer in its short-term interest rate segment last month.

“The team is working hard on the initiative, and we are confident that we will see further positive development in this segment towards the end of the year,” Lee Bartholomew, global head of derivatives product research and development for fixed income and foreign exchange, said in a post. “The advantages of having the entire EUR-denominated interest rate curve at one clearing house are obvious.”

Unlike other regions, Europe has opted not to mothball its Libor, panel-based rate, where ICE has maintained its position as the dominant venue with Euribor open interest at 16.2 million lots, according to figures provided by the group.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you